Latest News

Changes to Online Services for Businesses - November 2023

Posted

on 20 November 2023

)

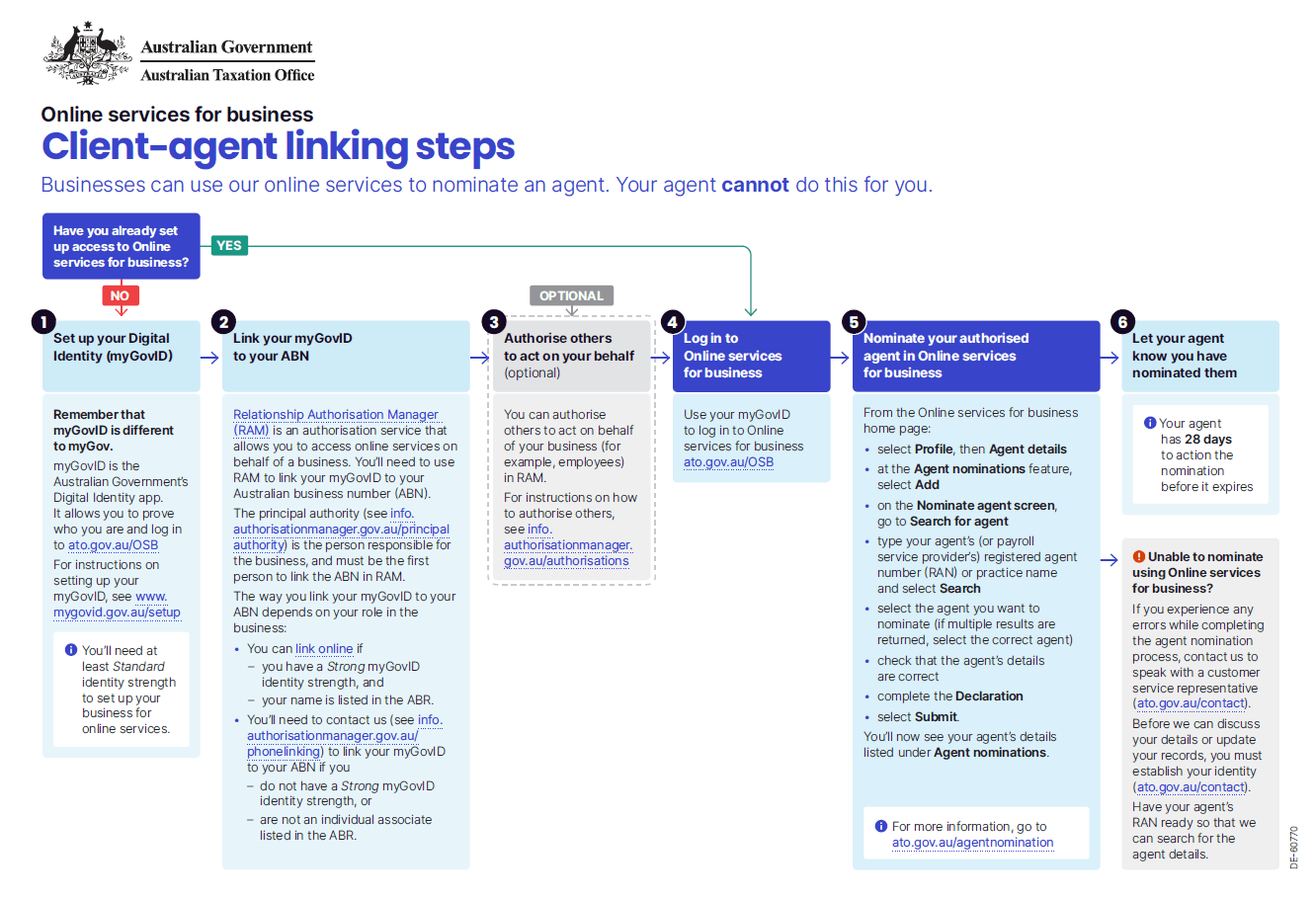

The Australian Taxation Office (ATO) is taking measures to enhance the security of its online services and protect users against fraud and identity theft. They have introduced a new feature in their Online services for business platform that allows businesses to better manage and control agent access to their tax and super affairs.

The new process ensures that only authorised tax agents, BAS agents, or payroll service providers can link to a business's account and access their financial ...

2023 Working From Home Deductions

Posted

on 6 April 2023

)

The ATO has made changes to the way that working from home deductions can be claimed by eligible taxpayers for the 2023 income year.

If you have genuinely worked from home at any time from 1 July 2022 to 30 June 2023, you may be eligible to use the ATO’s revised fixed-rate (67 cents per hour) method to claim for:

· energy expenses (i.e., electricity and gas) for lighting, heating/cooling, and to run electronic items used for work o...

2022 Tax - Motor Vehicle Travel and Log Books

Posted

on 7 March 2022

)

In the 2022 (current) tax year with all the changes in travel Covid has caused, the ATO has advised that it is going to be focused on deduction claims for Motor Vehicle Travel and review Motor Vehicle Log Books.

We would like to ensure that all clients have the right data this year to be able to make a claim using the Cents Per Kilometre method or Log Book Method. It is essential that you keep the correct documentation, please do not hesitate to contact our office if you need to check o...

We would like to ensure that all clients have the right data this year to be able to make a claim using the Cents Per Kilometre method or Log Book Method. It is essential that you keep the correct documentation, please do not hesitate to contact our office if you need to check o...

What information do you need to lodge to the ato and what documentation do I need to keep?

Posted

on 22 August 2020

)

The short answer is talk to your Accountant and Tax Agent to get it right for your particular situation and absolutely everything that has anything to do with your business and tax. One of the most common concerns for both Individuals and Business alike is failing to lodge the correct information to the ATO or not being fully aware of the documents that they must retain to make sure that their claims are valid in case of Audit.

We have seen this concern develop further over the last fe...

| Posted in:ATOTax Return |

Are you sure your company details are current?

Posted

on 22 August 2020

)

Details of every company registered in Australia are kept on our corporate register.

Companies must ensure that the details held on our corporate register are kept up to date by telling ASIC of any changes to these details. The Corporations Act 2001 (Corporations Act) requires companies to tell ASIC of changes to details on the appropriate form, generally within 28 days after the change.

See Information Sheet 20 Checklist for registered companies and their officers (INFO 20) for mo...

| Posted in:ASIC |